Having established in a previous post what the shape of Ontario’s society looks like, it’s time to build on that framework in order to allow us to understand the shape of the province’s beer industry over time.

For this, I’m pulling on Beer Canada statistical data that I’ve accumulated through following along closely over time and through LCBO annual reporting, which I’ve painstakingly collated by analyzing the data in their annual report. As a crown corporation, they have a duty to report accurately, but I’ve never seen anyone actually use that data or even point out that it exists. I should add the caveat that I write for Food & Drink, but that the data is objective so there’s nothing up my sleeve here.

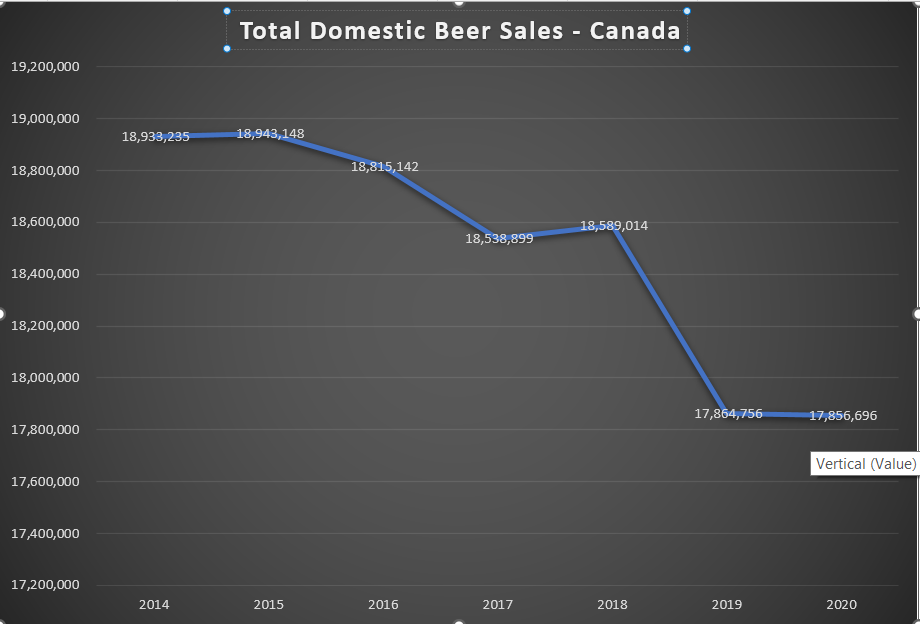

Beer Canada’s statistical reporting goes back as far as 2014, so that’s what we’ll be going with here. Import sales, it turns out, are fairly robust, so we’re going to ignore that for the time being. As you can see, domestic beer sales in Canada lost about 1,050,000 hL over the course of the period 2014-2020.

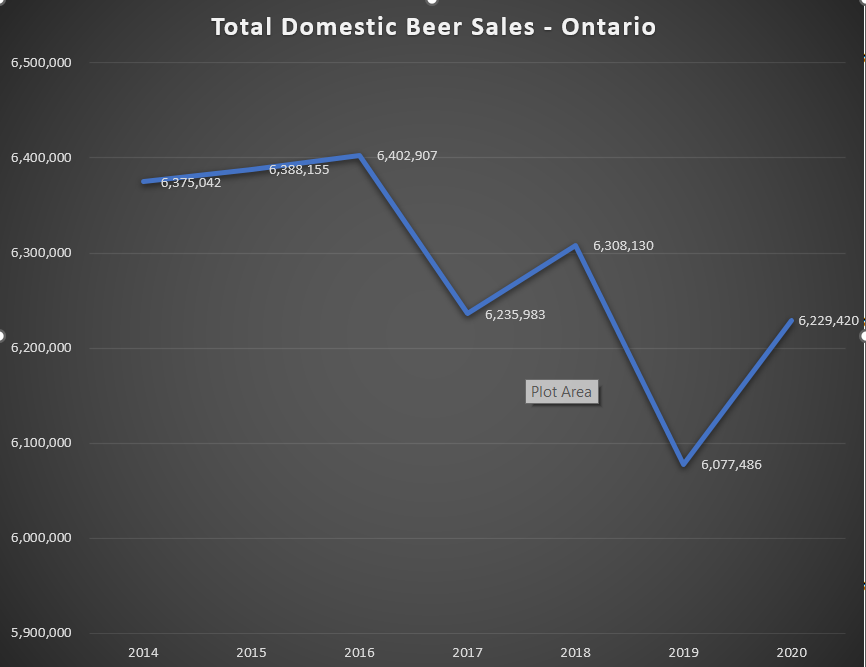

Since we’re talking about Ontario, let’s zoom in locally and see whether that decrease holds true for the province. You’ll see that domestic beer sales in Ontario has been on a downward trend, but that there is a significant uptick in 2020. This has to do with the fact that significant import brands like Spaten and Stella Artois are now brewed in London, Ontario by Labatt and therefore are considered domestic.

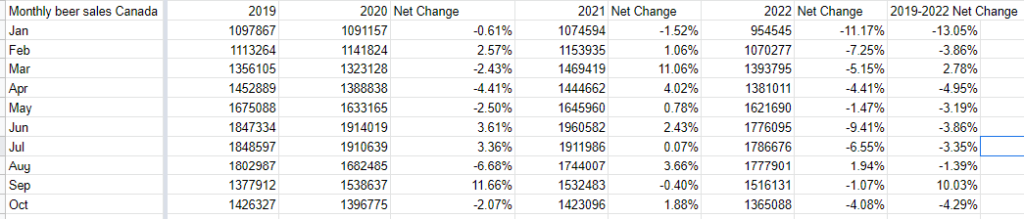

Without data for 2021 and 2022, I’m forced to manually collate the statistical data from Beer Canada’s statistics page. It has been a challenging couple of years as a result of the pandemic, and I suspect it is for that reason that there was no 2022 reporting from that organization. Nevertheless, the monthly statistical figures for Canada are available.

While we don’t have complete statistics for 2022 yet, the year over year figure has been hanging out around -4.8%. It’s not exactly fair to extrapolate based on that figure since there may be some manner of November and December turnaround. It’s unlikely, but possible.

If you look at the beer sales in Canada based on 2019, which was not a banner year, the market is operating at an average monthly rate of -2.5% from pre-pandemic sales. I’ll come back and update this post when we get the actual numbers, but I suspect it will be slightly worse given that December 2019 had a large uptick.

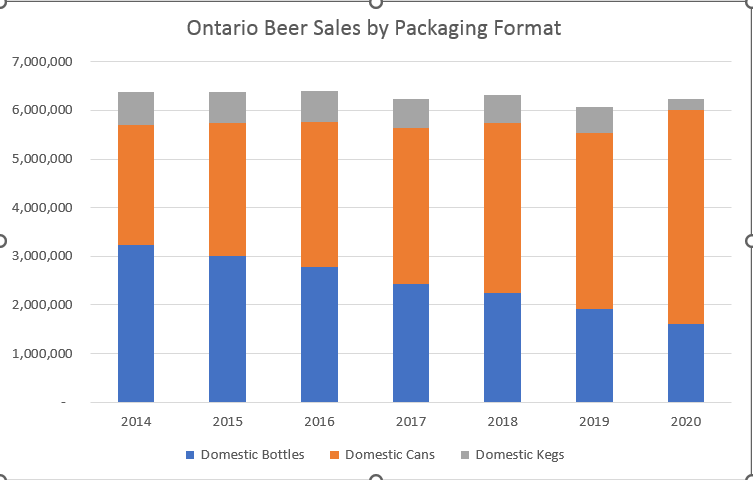

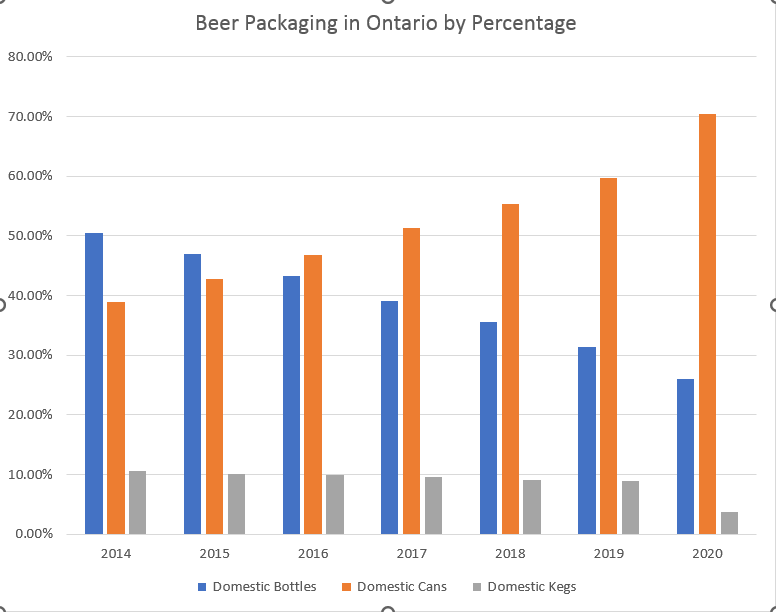

It’s safe to say, based on the numbers we’ve looked at so far that we’re in a downturn regardless of the pandemic, but that doesn’t tell the whole story. Let’s look at packaging formats and see how the beer that is selling is being sold.

Because of the pandemic and the closure of bars and restaurants for several months in 2020, we see a precipitous drop in the amount of kegged beer that is out there on the market. This is a situation that has had knock on effects for mid-sized craft breweries across the province of Ontario. Take Beau’s, Side Launch, Henderson, and Amsterdam, for example. If you relied on getting your beer out there on draught as part of your sales strategy, you were going to have really significant problems.

The other part of the story, however, is that the lack of draught sales means that the home consumer had to change their purchasing habits. The volume of canned beer as compared to bottled beer was exacerbated by the lack of draught sales. Here’s a visualization of how everything sits currently.

And here it is expressed as a percentage of the market. Draught was sitting at 3.68% by the end of 2020. While the pandemic meant that there was a significant drop, it was in significant decline prior to 2020. It will have recovered somewhat with restaurants open again, but it’s hard to say how much. It will be significantly lower than the 2018 figure.

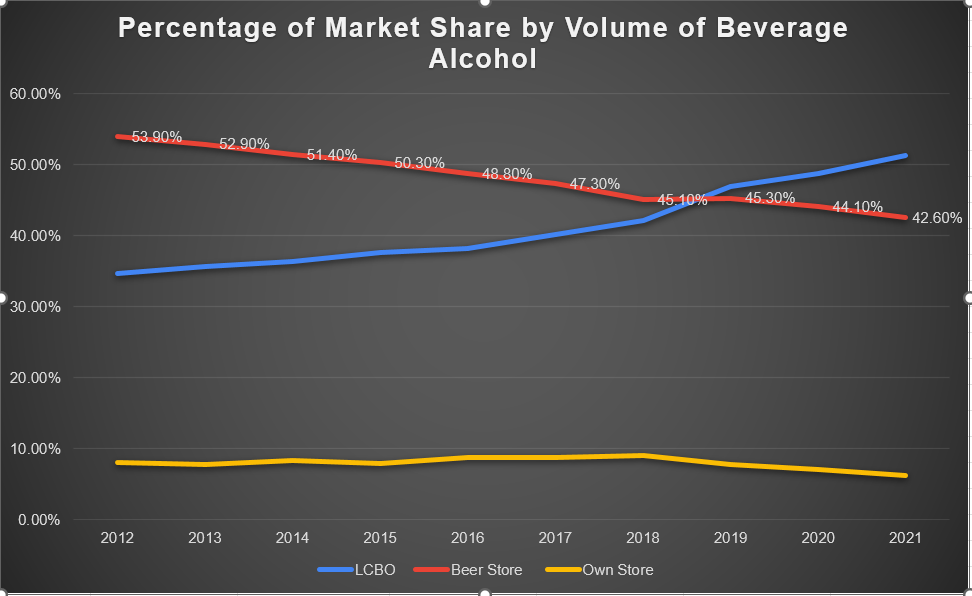

The lack of bottle sales is really problematic for an organization that deals predominantly with bottles: The Beer Store. According the LCBO’s annual reporting, we have figures for The Beer Store’s market share in terms of volume sales of alcoholic beverages in Ontario. Because beer sells more in terms of volume within the beverage alcohol market than do wine or spirits, a drop in their sales appears disproportionately high. In this case, they have lost 11.3% of the total retail market in the last decade (2012-2021)

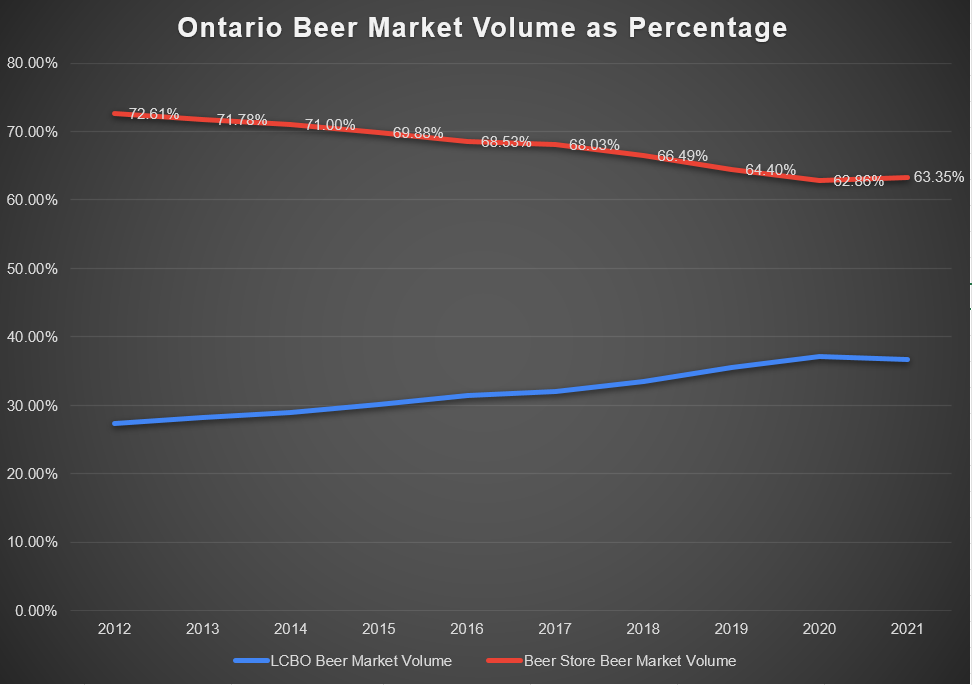

Let’s look at the beer market rather than the overall beverage market. You’ll note that The Beer Store has lost something like 10% of Ontario’s beer market. It is actually worse than that as the LCBO’s annual report includes brewery own-sales as a part of beer store sales. It is probably more like 12%.

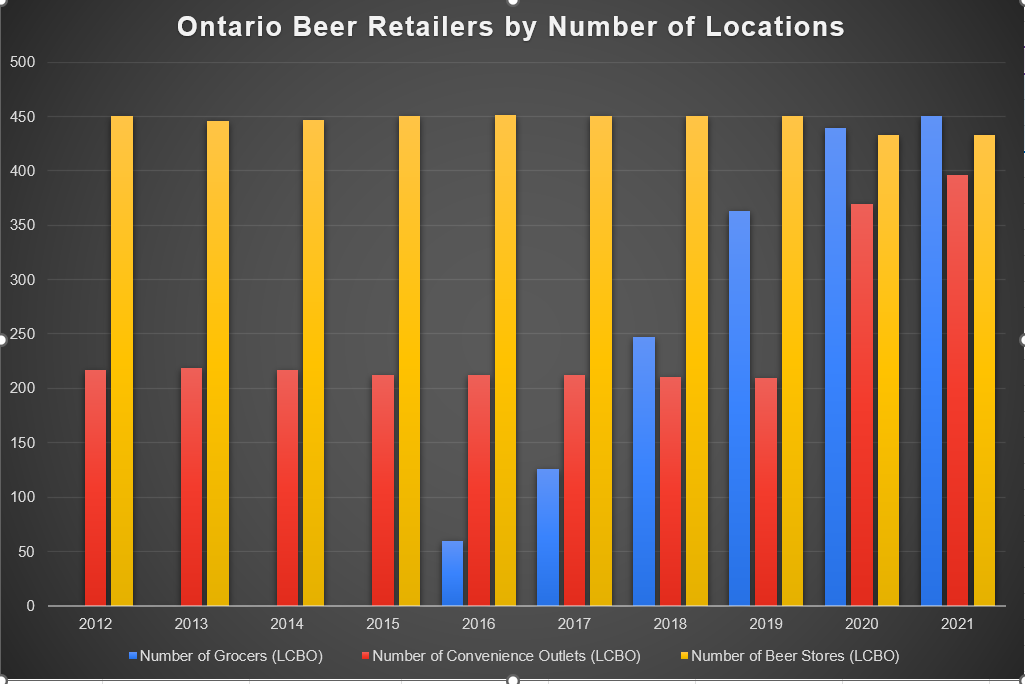

You might be wondering about the Master Framework Agreement, which looms over the heads of The Beer Store. Well, since 2015, we have had an increase in the number of retailers for beer in the province of Ontario. It includes grocery and additional retail locations for the LCBO including agency stores in convenience outlets. The number of outlets of The Beer Store has dropped slightly, as you can see. The increase in convenience store outlets coincides loosely with discussion about scrapping the Master Framework Agreement, although it would be irresponsible to suggest that as a causative factor.

Let’s recap: So far, what we’ve learned is that we have an aging population and that people are drinking less beer per capita than at any time since the second world war. Not only is volume down, but it is down in the face of significant reform of the retail system within the province which only show signs of continuing in 2025 when the Master Framework Agreement runs out and allows for additional grocery locations to sell beer. We have increased ease of access, but decreased demand. The switch to cans likely means people are buying individual cans at retail instead of multi-unit packages.

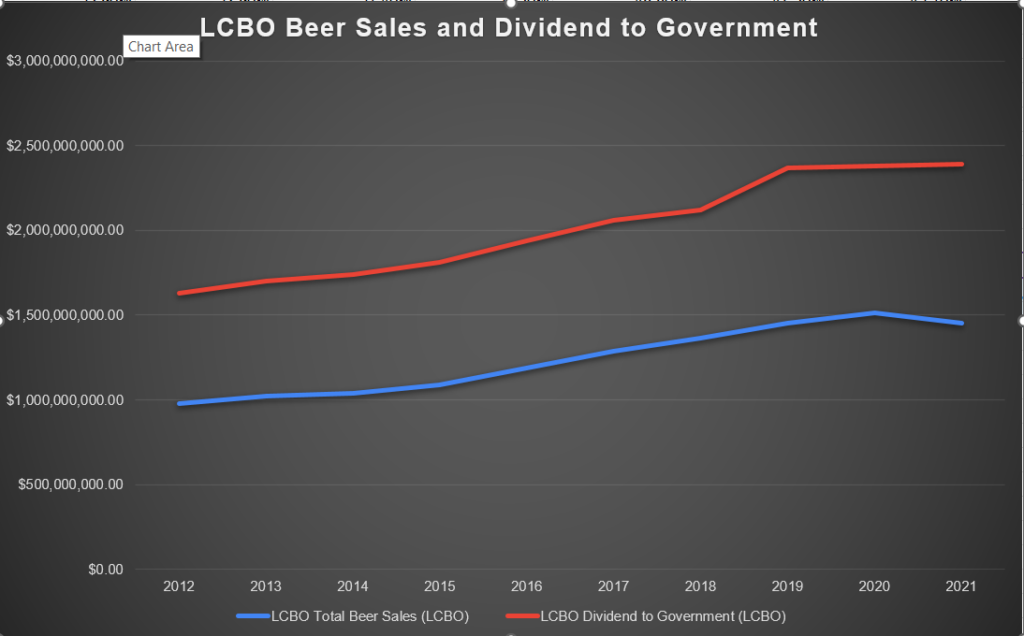

You might wonder, what does that do to the overall market cap? It turns out that the LCBO’s increase in beer sales through grocery and agency store channels accounted for something like 534 Million dollars, which clearly correlates with their remittance to the province.

If that was ten percent of The Beer Store’s sales, the remaining 63 percent of the market, should retail fall under LCBO control as a result of retooling of the Master Framework Agreement in 2025, the province would stand to clear something like 3.4 Billion in additional sales.